Global semiconductor revenue is expected to reach $429 billion in 2019, down 9.6% from $475 billion in 2018, Gartner said.That's down from the previous quarter's forecast of -3.4%.

"The semiconductor market is affected by many factors," said Ben Lee, senior principal research analyst at Gartner.A weaker price environment for memory and other types of chips, coupled with the us-china trade dispute and slower growth in key products that use semiconductors, including smartphones, servers and PCS, is pushing the global semiconductor market to its slowest pace since 2009.Semiconductor product managers should review production and investment plans to protect themselves from this weak market."

The glut of DRAM demand will drive prices down 42.1% in 2019, and is expected to continue through the second quarter of 2020.Prices have plummeted because of a slower recovery in demand from super-sized suppliers and increased inventories of DRAM suppliers.An extended period of short supply in the DRAM industry came to an abrupt end.

The long-running us-china trade dispute is creating uncertainty over trade turnover rates.The restrictions imposed by the us on Chinese companies because of security concerns will have long-term implications for supply and demand of semiconductors.Taken together, these problems will accelerate China's domestic semiconductor production and spawn local offshoots of technologies such as ARM processors.During the dispute, some manufacturing operations will move outside China, and many companies will seek to diversify their manufacturing bases to reduce any further disruption.

The global NAND market, which has been oversupplied since the first quarter of 2018, is particularly acute now that demand for NAND has been weaker than expected recently.

"We expect high smartphone inventories and depressed demand for solid state arrays to continue for several more quarters," said Mr Lee.Given the sharp fall in NAND prices, a more balanced supply/demand picture is likely in 2020.However, due to slowing demand growth factors such as PCS and smartphones, as well as the impact of new chip manufacturers in China on the market and increased capacity, the future situation is not optimistic."

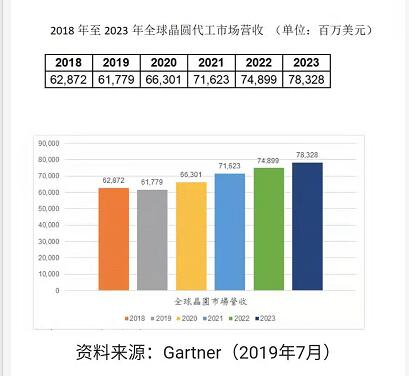

Gartner predicts that the overall wafer foundry market from 2018 to 2023, the compound annual growth rate of 4.5%, the market revenue is expected to reach $78.3 billion in 2023, in the next few years, in addition to Japan and South Korea trade war, a trade war with China will also affect the semiconductor market, will force China to future self development as far as possible, to develop Chinese standards, from dependence on the United States, that the United States and the country is sent two sets of electronic products on display standard.To effectively seize new opportunities and reduce risks, suppliers need to prepare well in advance and diversify their supply sources of raw materials, parts and equipment.

Englisch

Englisch  Chinesisch

Chinesisch  Deutsch

Deutsch  Koreanisch

Koreanisch  Japanisch

Japanisch  Farsi

Farsi  Portuguese

Portuguese  Russian

Russian  Spanisch

Spanisch